Exhibit A

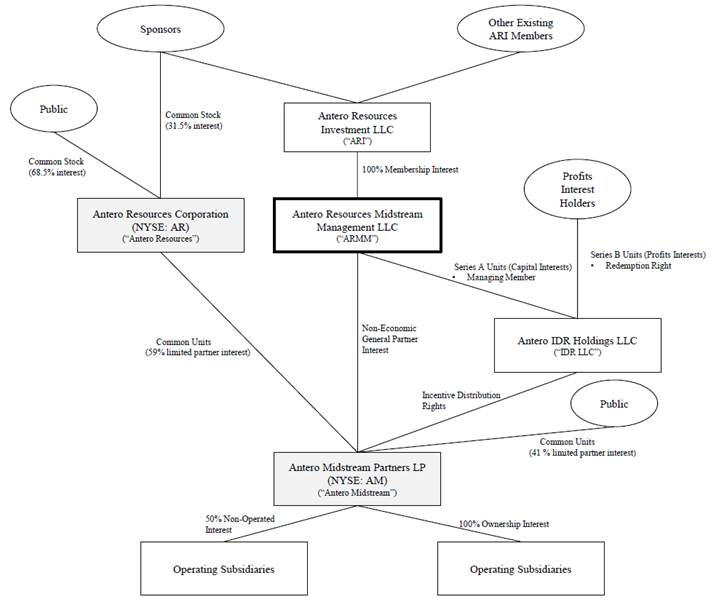

Pre-Reorganization Structure

Antero Resources Midstream Management LLC

1615 Wynkoop Street

Denver, Colorado 80202

March 27, 2017

VIA EDGAR

Securities and Exchange Commission

Division of Corporation Finance

100 F Street, N.E.

Washington, D.C. 20549

Attn: Mara L. Ransom, Assistant Director

Office of Consumer Products

Re: Antero Resources Midstream Management LLC

Amendment No. 1 to

Draft Registration Statement on Form S-1

Submitted March 2, 2017

CIK No. 0001623925

Ladies and Gentlemen:

Set forth below are the responses of Antero Resources Midstream Management LLC (the “Company,” “we” or “us”) to comments received from the staff of the Division of Corporation Finance (the “Staff”) of the Securities and Exchange Commission (the “Commission”) by letter dated March 23, 2017, with respect to the Company’s confidential second draft registration statement on Form S-1 submitted to the Commission on March 2, 2017 (the “Draft Registration Statement”). Concurrently with the submission of this letter, we are filing through EDGAR a revised registration statement on Form S-1 (the “Registration Statement”). For your convenience, we will hand-deliver three full copies of the Registration Statement, as well as three copies of the Registration Statement marked to show all changes to the Draft Registration Statement.

For the convenience of the Staff, we have reproduced the Staff’s comments in bold, italicized text and have followed each comment with the Company’s response. All references to page numbers and captions correspond to the Registration Statement unless otherwise specified.

Organizational Structure

Management, page 15

1. We note you continue to disclose that you will effectively control Antero Midstream through your role as the managing member of Antero Midstream’s general partner, AMP GP. However, your response to comment 10 appears to indicate you believe AMP GP will base its operating and capital investment decisions on the operating and capital

Securities and Exchange Commission

March 27, 2017

investment decisions of Antero Resources, and therefore Antero Resources, rather than AMP GP effectively controls the most significant decisions of Antero Midstream. Please explain to us in more detail this apparent difference in your identification of the entity effectively controlling Antero Midstream. In doing so, please respond to the following:

· Please describe to us in detail your ability to direct the activities that most significantly impact Antero Midstream’s economic performance through its general partner AMP GP, and contrast this with Antero Resource’s power. As part of your response, address the following:

· Tell us whether AMP GP can sign contracts with other customers such that Antero Midstream is no longer dependent upon Antero Resources.

· Tell us the extent to which AMP GP can direct Antero Midstream to differ its capital investment decisions from those made by Antero Resources, and separately describe any legal or economic consequences to such a decision.

· Tell us the decisions impacting Antero Midstream’s economic performance that you can make as the managing member of AMP GP, and contrast those to the decisions impacting Antero Midstream’s economic performance that are made by AMP GP’s board of directors. Also provide us with your analysis of whether Antero Resources effectively controls AMP GP’s board of directors.

· Provide us with any additional information to help us understand why you believe Antero Resources, rather than AMP GP, directs the most significant activities of Antero Midstream.

· Explain to us in more detail how you considered your relationship with Antero Resources during your analysis of Antero Midstream’s primary beneficiary. In doing so:

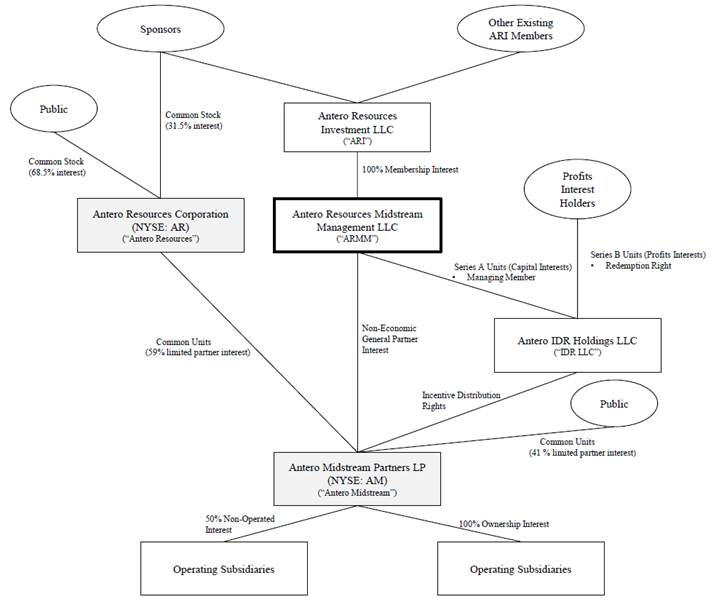

· Clarify the extent to which you and Antero Resources have common ownership or are under common control, and revise the organizational structure chart in your filing as needed to clarify this matter to your investors.

· To assist us in understanding this matter, please also provide us with an organizational chart depicting the relationship between the Sponsors, Antero Resources, Antero Midstream, and your predecessor ARMM prior to the Reorganization.

· Tell us how you considered your shared officers and directors during your analysis of Antero Midstream’s primary beneficiary and explain to

Securities and Exchange Commission

March 27, 2017

us in significantly more detail the extent to which it is possible for you to make decisions and, through AMP GP, direct the decisions of Antero Midstream independently from the decisions made by these shared officers and directors on behalf of Antero Resources.

· If you believe that Antero Resources controls the most significant decisions made by Antero Midstream and that you, through AMP GP, control less significant decisions, tell us in more detail why you believe it is appropriate to characterize your relationship with Antero Midstream as effectively controlling its business and affairs. Tell us whether it would be correct to state that you control Antero Midstream on behalf of Antero Resources or for the benefit of Antero Resources, and if not, why not.

RESPONSE:

We acknowledge the Staff’s comment and have provided the analysis below to address the Staff’s request for clarification. We also refer the Staff to the structure charts attached hereto as Exhibits A and B, which reflect our organizational structure before and after the completion of the offering and the related reorganizational transactions described in the prospectus (the “Reorganization”), respectively, as well as the updated disclosure provided on pages 6, 16, 18, 45, 118, 128, F-7 and F-8 to more clearly reflect the analysis below.

In determining whether Antero Midstream Partners GP LLC (“AMP GP”) or Antero Resources Corporation (“Antero Resources”) will have the power to direct the activities that most significantly impact the economic performance of Antero Midstream Partners LP (“Antero Midstream”) and, therefore, to be the primary beneficiary of Antero Midstream, we considered both (i) the power that AMP GP will exercise as the general partner of Antero Midstream pursuant to the Agreement of Limited Partnership of Antero Midstream dated November 10, 2014 and incorporated by reference as an exhibit to the Registration Statement (as amended, the “AM Partnership Agreement”), and (ii) the purpose and design of Antero Midstream, which is to provide services to Antero Resources. In addition, we considered the common membership of the boards of directors of Antero Resources, AMP GP and our general partner (“AMGP GP”), as previously described in our response letter to the Staff dated March 2, 2017 (the “Initial Response Letter”). In considering these elements, we examined in particular the nature and characteristics of Antero Midstream’s activities and operations.

Antero Midstream was designed and formed to act as Antero Resources’ midstream service provider, and Antero Resources continues to supply Antero Midstream with the requisite personnel to fulfill such purpose.

As described in the Registration Statement, Antero Midstream is a growth-oriented limited partnership formed to own, operate and develop midstream energy assets to service Antero Resources’ production. Antero Midstream’s assets are located in North American shale plays in which Antero Resources conducts its operations

Securities and Exchange Commission

March 27, 2017

and consist of gathering pipelines, compressor stations, processing and fractionation plants and water handling and treatment assets, through which Antero Midstream provides midstream services to Antero Resources under long-term, fixed-fee contracts with initial terms of up to 20 years and automatic annual renewal provisions. For the year ended December 31, 2016, Antero Midstream generated 99.86% of its consolidated revenues from these contracts with Antero Resources.

Prior to Antero Midstream’s formation, Antero Resources acquired, developed and operated the assets that comprised Antero Midstream’s initial business. Antero Resources formed Antero Midstream’s predecessor as a separate entity and contributed these assets to Antero Midstream to finance the continued expansion and development of the midstream infrastructure supporting Antero Resources’ business through direct access to the capital markets, among other reasons. Since that initial contribution of assets and its initial public offering, Antero Midstream has continued to develop its asset base to serve Antero Resources’ growing midstream needs. As a result, substantially all of the capital investment and operating decisions of Antero Midstream since its initial public offering have been, and for the foreseeable future will continue to be, dependent on the capital investment and operating decisions made by Antero Resources.

Further, because Antero Midstream does not have any employees, it depends on Antero Resources to supply the personnel who operate Antero Midstream’s business. The officers of Antero Resources act as officers of the general partner of Antero Midstream and provide services to Antero Midstream under a services agreement among Antero Resources, Antero Midstream and its general partner. In addition, Antero Resources also seconds employees to Antero Midstream to provide operational services with respect to the gathering and processing assets and water handling and treatment assets operated for the benefit of Antero Resources pursuant to a secondment agreement among Antero Resources, Antero Midstream and its general partner. Thus, Antero Resources’ employees are responsible for the day-to-day operations of Antero Midstream, including core administrative functions such as accounting, finance, human resources, legal and tax. Similarly, we will not have any employees and will rely on Antero Resources and its officers to provide services on our behalf under the terms of a services agreement to be entered into in connection with our initial public offering. Due to the presence of these factors, AMP GP is practically constrained with respect to the decisions that it can make on behalf of Antero Midstream.

Antero Midstream is limited in its ability to provide significant services to customers other than Antero Resources.

While AMP GP has the authority to execute contracts on behalf of Antero Midstream with customers other than Antero Resources and to direct capital investment decisions away from Antero Resources to other customers, Antero Midstream does not have the physical capacity or the practical ability, based on its asset base, capital and operating personnel to provide a significant amount of services to any customer other than Antero Resources while continuing to perform under its long-term contracts with Antero Resources, which have initial terms of up to 20 years and contain automatic annual renewal provisions. If Antero Midstream were to fail to perform under its contracts with Antero Resources and such contracts were terminated, it is unlikely due to geographical constraints, potential capital investments to meet new customer specifications and other logistical considerations that Antero Midstream would be able to enter into replacement contracts with third parties on similar or more favorable terms, or at all,

Securities and Exchange Commission

March 27, 2017

and such termination could have a material and adverse effect on Antero Midstream. As a result, Antero Midstream relies, and will continue to rely for the foreseeable future, on Antero Resources for virtually all of its revenues. Thus, although AMP GP has the authority under the AM Partnership Agreement to direct the activities of Antero Midstream as the general partner, it would not currently be in AMP GP’s or Antero Midstream’s interest to direct the activities of Antero Midstream in a manner that would not benefit or support the purpose and design of Antero Midstream to serve Antero Resources. For this reason, we have identified for potential investors in our common shares the risks facing Antero Resources’ business and the impact those risks could have on Antero Midstream and, in turn, our investors. Please see, for example, “Risk Factors—Risks Related to Antero Midstream’s Business—Because substantially all of Antero Midstream’s revenue is derived from Antero Resources and Antero Resources’ capital decisions drive our operations, any development that materially and adversely affects Antero Resources’ operations, financial condition or market reputation could have a material and adverse impact on us” in the Registration Statement.

In addition, we acknowledge that the individuals and entities responsible for appointing all of the members of the board of directors of our general partner (collectively, the “Sponsors”) own approximately 31.5% of the outstanding shares of common stock in Antero Resources and also comprise five of the eight members of the board of directors of Antero Resources.

The activities of Antero Midstream that most significantly affect its economic performance are performed under contractual obligations with Antero Resources. The activities that most significantly impact Antero Midstream’s economic performance relate to its capital investment decisions and long-term growth projects associated with its gathering, compression and water systems. In determining whether Antero Midstream should undertake a capital investment to pursue an expansion or modification of its operations, the officers of Antero Midstream consider primarily whether such investment or operational development accords with Antero Resources’ drilling and completion plans. For example, Antero Midstream is unlikely to undertake an expansion of a gathering system or a capital-intensive operational modification unless the increased capacity is supported by a planned increase in Antero Resources’ drilling and completion activity in the region served by the gathering system. By linking its capital investment and operational decisions to the needs of, and its contractual arrangements with, Antero Resources, Antero Midstream is able to ensure a new capital project or modification is supported by a contract capable of generating sufficient revenue to offset the cost of such project or modification over time, reducing the risk associated with large, expensive capital projects and modifications. In addition, Antero Midstream has visibility into Antero Resources’ long-term growth plans through shared personnel, which is critical to its ability to pay and increase quarterly cash distributions to it unitholders over time. As a result, through its familiarity with Antero Resources’ growth plan, Antero Midstream is able to develop assets and undertake related financing activities with an understanding of how its growth plan accords with the long-term requirements of its primary customer. In this way, Antero Resources and Antero Midstream are able to create a “just in time” synergy, whereby Antero Resources generally has contracted midstream infrastructure when needed and Antero Midstream significantly reduces the risks of completing a capital project without the support of a long-term, fixed fee contract. Similarly, as a result of this synergy, Antero Midstream focuses its operational modifications on changes that will benefit Antero Resources. Antero Midstream

Securities and Exchange Commission

March 27, 2017

is unable to achieve a similar relationship with third party customers because it does not share personnel with such customers and, accordingly, lacks comparable visibility into their short-term drilling and completion plans and long-term growth strategy. Thus, Antero Midstream’s investment and operational decisions are substantively controlled by the shared directors, officers and employees of Antero Resources and the fact that Antero Resources owns 59% of the outstanding common units of Antero Midstream. Accordingly, we have concluded that Antero Resources is the primary beneficiary of Antero Midstream.

Comparison of Antero Resources’ Power and AMP GP’s Authority over Antero Midstream

Through its ownership of the general partnership interest in Antero Midstream and pursuant to the terms of the AM Partnership Agreement, AMP GP has the legal authority to direct the activities of Antero Midstream. However, because of (i) the contractual arrangements in place between Antero Resources and Antero Midstream, which utilize substantially all of Antero Midstream’s existing assets and represent virtually all of Antero Midstream’s revenue, (ii) Antero Midstream’s reliance on Antero Resources’ officers and employees to manage and conduct the day-to-day operation of its business and (iii) the substantial overlap between the boards of directors of Antero Resources and Antero Midstream, Antero Resources exerts substantive control over the activities that Antero Midstream that most significantly impact Antero Midstream’s economic performance.

We acknowledge that the substantive power that Antero Resources has over Antero Midstream is different than the legal control that AMP GP will exercise over Antero Midstream as its general partner. As a result, we believe it is accurate to state that AMP GP will control Antero Midstream consistent with its contractual obligations for the benefit of Antero Resources. We further acknowledge that this arrangement is distinguishable from traditional midstream master limited partnerships (“MLPs”) in which the upstream sponsor forms the MLP and continues to own the general partner interest in the MLP, thereby consolidating both the legal control and the substantive power in a single entity.

For the reasons described above and in our Initial Response Letter, we believe that Antero Resources has the power to direct activities that most significantly impact Antero Midstream’s economic performance without itself directly owning the general partner interest in Antero Midstream.

Summary Historical Financial Data

Antero Midstream Summary Historical Financial Data, page 25

2. We note that the table on page 25 presents an Adjusted EBITDA metric that includes income and expense attributable to the parent for periods prior to the Water Acquisition and that the tabular reconciliation of Net Income to Adjusted EBITDA on page 27 does the same. However, the definition of Adjusted EBITDA at the top of page 26 and the related explanation of why management believes this metric is useful indicate that it excludes pre-acquisition income and expense attributable to the parent, and it appears to instead

Securities and Exchange Commission

March 27, 2017

describe the metric titled Adjusted EBITDA attributable to Antero Midstream. Please conform the title of the metric you present and the description of how it is calculated to the tabular reconciliation seen on page 27. If you continue to present the metric currently called Adjusted EBITDA, ensure that your description of why this metric is useful to investors explains why including the income and expenses related to the pre-acquisition period during which Antero Midstream had no control over the water acquisition assets results in a metric that serves as an indicator of Antero Midstream’s performance.

RESPONSE:

We acknowledge the Staff’s comment and we advise the Staff that Antero Midstream includes the income and expenses related to the pre-acquisition period during which Antero Midstream did not control the water acquisition assets in its calculation of Adjusted EBITDA because Antero Midstream’s historical financial statements were recast in connection with such acquisition to include the income and expenses related to the pre-acquisition period, as the acquisition occurred between entities under common control. In addition, excluding the income and expenses related to the pre-acquisition period during which Antero Midstream did not control the water acquisition assets would result in higher period over period Adjusted EBITDA growth, which we believe would be potentially confusing and misleading to our investors.

Our Cash Distribution Policy and Restrictions on Distributions, page 68

3. Refer to the first full bullet point on page 69 which describes the authority AMP GP has over Antero Midstream’s cash reserves that reduce distributable cash and over changes to Antero Midstream’s cash distribution policy. Given that you are the managing member of AMP GP, please revise to clarify to your investors the extent to which you control these items. It is not clear from your current disclosure that these represent restrictions that are outside of your control.

RESPONSE:

We acknowledge the Staff’s comment and have revised the Registration Statement accordingly. Please see page 70.

Estimated Cash Available for Distribution Based upon Adjusted EBITDA of Antero Midstream Partners LP, page 75

4. We note your response to comment 13. We further note your disclosure on page 91 that in 2017 Antero Midstream will make a $275 million capital investment in the Joint Venture. Please revise your narrative assumptions in an appropriate location to clarify the timing of this capital investment and how it will be funded. We note from your disclosure on page F-35 that a portion of this capital investment was effectively funded with new equity

Securities and Exchange Commission

March 27, 2017

issuances by Antero Midstream, but it is unclear how and when the remainder will be funded and why this would have no impact on cash available for distribution during the forecast period.

RESPONSE:

We acknowledge the Staff’s comment and have revised the Registration Statement accordingly. Please see pages 82, 83 and 92.

Illustrative Example — AMGP Cash Available for Distribution, page 4

5. We have reviewed your response to comment 15 and have the following comments:

· You state in your response that you expect to fund your expansion capital expenditures with a combination of cash flows from operations and borrowings under your revolving credit facility; however, your “Expansion capital expenditures” $580 million cash outflow line item and “Borrowing to fund expansion capital expenditures” $580 million cash inflow line item on page 77 suggest you have assumed that all of your expansion capital expenditures will be financed. Please reconcile the assumptions contained in your response with the assumptions presented in your filing.

· Also, we note that footnote (a) on page 77 and the financing assumptions on page 82 state that your forecasted interest is based on the assumption that you will finance $450 million of your expansion capital expenditures. Please reconcile these statements to the table on page 77 showing that the entire $580 million of expansion capital expenditures will be financed and showing no debt repayments.

RESPONSE:

We acknowledge the Staff’s comment and have revised the Registration Statement accordingly. Please see pages 78, 79 and 83.

Antero Resources Midstream Management LLC Financial Statements for the Year Ended December 31, 2016

Note (2) Summary of Significant Accounting Policies

(b) Investment in Antero Midstream, page F-7

6. We note you account for your ownership of the IDRs of Antero Midstream using the equity method of accounting. Please provide us with your analysis of whether the IDRs are in-substance common stock. Also, tell us how you determined the balance in the investment account should solely consist of IDR distributions attributable to you by Antero Midstream but not yet paid, and whether you considered other presentations of your rights to Antero Midstream’s net assets such as the HLBV method.

Securities and Exchange Commission

March 27, 2017

RESPONSE:

We acknowledge the Staff’s comment and provide the analysis below to support our conclusion that the equity method of accounting is appropriate for the ownership of the incentive distribution rights (“IDRs”) of Antero Midstream.

In-Substance Common Stock

We respectfully advise the Staff that we do not believe the analysis of whether the IDRs are in-substance common stock is applicable, as ASC 323-10-15-5 states that the guidance of ASC 323-10 does not apply to an investment in a partnership, an unincorporated joint venture or a limited liability company. We believe ASC 323-30-S99-1 provides the authoritative support to use the equity method of accounting for the IDRs, which are in form equity interests in a partnership. ASC 323-30-S99-1 requires the equity method of accounting for an investment in a partnership unless the investor’s interest “is so minor that the limited partner may have virtually no influence over partnership operating and financial policies.” We believe that the IDRs represent an interest that is “more than minor” and should be accounted for using the equity method of accounting.

Balance of the Investment Account

In determining the balance of the investment account, we have relied upon ASC 323-10-35-4 which states, “Under the equity method, an investor shall recognize its share of the earnings or losses of an investee in the periods for which they are reported by the investee in its financial statements rather than in the period in which an investee declares a dividend.” Antero Midstream allocates earnings in its financial statements at the end of each reporting period to the holders of the IDRs and the holders of the Common Units to their respective capital accounts. The amount allocated to holders of the IDRs is equal to their rights in the distribution declared shortly after the end of the reporting period and paid within 45 days after the end of the reporting period. We believe that recognizing equity in earnings based on the amount allocated to the capital account of the IDR holders in Antero Midstream’s financial statements is an accurate representation of the amount of cash flow that will ultimately be realized by us. Because we have no other invested balance in Antero Midstream, the balance of the investment account at the end of the reporting period is equal to distributions declared but not yet paid.

Pursuant to the terms of the AM Partnership Agreement, the general partner of Antero Midstream has no equity interest in Antero Midstream or rights upon liquidation other than its right to receive the balance, if any, in its capital account upon liquidation. The AM Partnership Agreement does not provide for the allocation of losses to the general partner of Antero Midstream or the holder of the IDRs and, thus, AMP GP is not obligated to fund any shortfalls as the general partner of Antero Midstream. Therefore, we believe the application of the HLBV method of accounting would result in the same amounts as recorded under traditional equity accounting. We believe that the usual method of applying equity accounting is appropriate for the general partner’s interest in the IDRs.

Securities and Exchange Commission

March 27, 2017

7. Please tell us how you complied with the disclosure requirements of ASC 810-10-50-5A.

RESPONSE:

We acknowledge the Staff’s comment and have revised the Registration Statement accordingly. Please see pages F-7 and F-8.

* * * *

Please direct any questions or comments regarding this correspondence to our counsel, Ryan J. Maierson of Latham & Watkins LLP at (713) 546-7420.

|

|

|

| |

|

|

Sincerely, |

| |

|

|

|

| |

|

|

Antero Resources Midstream Management LLC | ||

|

|

|

| |

|

|

/s/ Glen C. Warren, Jr. | ||

|

|

Name: |

Glen C. Warren, Jr. | |

|

|

Title: |

President, Chief Financial Officer and Secretary | |

Enclosures

cc: Alvyn A. Schopp, Antero Resources Midstream Management LLC

Yvette K. Schultz, Antero Resources Midstream Management LLC

William N. Finnegan IV, Latham & Watkins LLP

Ryan J. Maierson, Latham & Watkins LLP

David P. Oelman, Vinson & Elkins L.L.P.

Exhibit A

Pre-Reorganization Structure